Individual Case Study (1750 words, 50% of assessment weighting) For this individual case study, you are required to analyse the company that you have been allocated for Assessment 1. The COVID.

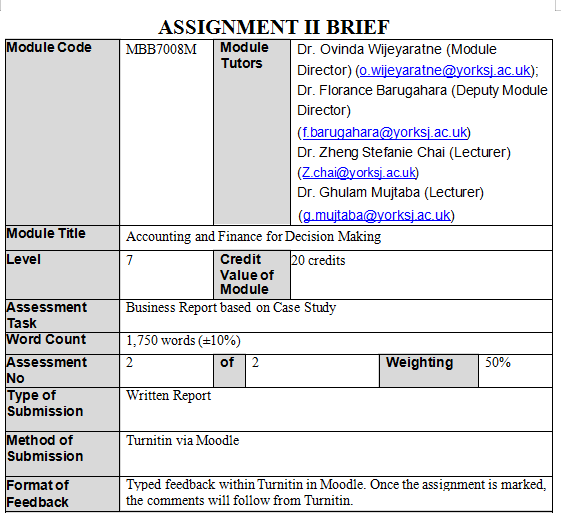

MBB7008M Accounting and Finance for Decision Making Assignment 2 Brief | YSJU. GET THIS PAPER DONE AT ESSAYLINK.NET

Programme Learning Outcomes (PLO)

Upon successful completion of the module students will be able to: LO.1 Master the various aspects of financial analysis;

LO.2 Be able to determine the value, value creation and investment decisions of a firm;

LO.3 Apply risk management techniques in a business to hedge risky projects;

LO.4 Have an overall appreciation of the application of financial management theories to practice.

This assessment covers the following LO’s:

LO.2 Be able to determine the value, value creation and investment decisions of a firm; LO.3 Apply risk management techniques in a business to hedge risky projects;

LO.4 Have an overall appreciation of the application of financial management theories to practice.

Assignment Description

Individual Case Study (1750 words, 50% of assessment weighting)

For this individual case study, you are required to analyse the company that you have been allocated for Assessment 1.

The COVID-19 pandemic has affected the businesses and economy dramatically. The Board of Directors is currently considering diversifying its business risk and plans to make some investments that would help the business sustain and grow in the long term. Assuming you were the Chief Financial Officer of the company/organisation, you were tasked to produce a report to the Board of Directors that identifies a potential investment project to help the business grow in the post COVID-19 environment.

Write a business report to the Board of Directors of your allocated company. In your report, you shall propose an investment project, and the cashflows for the proposed investment project is provided to you in the Moodle page. For the proposed project you need to consider the risk and return, evaluating the investment opportunity and analysing its potential impact on the company/organisation with consideration of its financial performance before you make recommendation, including the following discussions:

1.Executive Summary (250 words)

- Introduction of the company

- Purpose of the report

- Conclusion from your analysis and discussion

- Recommendations on how the company should proceed with the investment

2.Motivation of the proposed investment (200-300 words)

- Propose an investment that will help the company to sustain and grow in the long- term. Make sure the investment is relatable to the company. Incorporate the Why, How and Whatmodel:

oWhy? Purpose: - What is the real problem?

- Why is it important to resolve the problem?

oHow? Process: - How is the problem being caused?

- How must causal drivers of the problem change?

oWhat? Proposition: - What capabilities enable necessary changes in drivers?

3.Conduct investment appraisal using both quantitative and qualitative information (700-800 words)

- Using the relevant cashflows, calculate the Payback Period for the proposed investment

- Using the relevant cashflows, calculate the Accounting Rate of Return (ARR) for

the proposed investment. - Using the relevant cashflows, calculate the Net Present Value (NPV) for the investment, applying the discounted cash flow method at the company’s required rate of return.

- Comment on whether the company should proceed with the proposed investment according to the Payback Period, ARR and NPV calculations

- Identify and explain any 8 other factors which the company should consider in relation to the potential investment in this new machinery. These could be additional positive or negative factors. Ensure you include points which are specific to the nature of the investment, company, and current economic conditions (use PESTLE or SWOT analysis)

4.Critically discuss the risk and return and its potential impact on its financial performance (300-400 words)

- Conduct a Sensitivity analysis for the risk (Cost of Capital, Initial Investment, Scrap Value, and Cashflows) and return (NPV)

- Discuss the risk and return and potential impacts on the company’s financial

performance and position. - Discuss any Foreign Exchange Risk and Dividend Policy

Do You Need MBB7008M Assignment 2 of This Question

Order Non Plagiarized Assignment

Additional Information

Relevant

Data can be assessed via FAME for publicly traded UK company, stock exchange, Yahoo Finance, as well as the annual report and official website.

Analysis, links, examples and applications of the concepts and discussion should be made to current businesses and situations to show understanding of this module and its contents.

Reference should follow Harvard Referencing Guide. Please do not copy and paste other resources in your report. The appendices of the report shall include relevant supporting

Assessment Regulations

- Your attention is drawn to the University policy on cheating and plagiarism (or collusion).Penalties will be applied where a student is found guilty of academic misconduct, including termination of programme Policy Link

- You are required to keep to the word limit set for an assessment and to note that you maybe subject to penalty if you exceed that limit. (Policy Link) You are required to provide an accurate word count on the cover sheet for each piece of work you submit.

- For late or non-submission of work by the published deadline or an approved extended deadline, a mark of 0NS will be recorded. Where a re-assessment opportunity exists, a student will normally be permitted only one attempt to be re- assessed for a capped mark.(Policy Link).

- An extension to the published deadline may be granted to an individual student if they meet the eligibility criteria of the Exceptional Circumstances Policy.

Please see the assessment criteria below.

MBB7008M York St John University Level 7 Assessment Descriptor

|

|

PASS GRADES |

FAIL GRADES |

|||||

|

(100-85) |

(84 – 70) |

(69 – 60) |

(59 – 50) |

(49 – 40) |

(39 – 20) |

(19 – 0) |

|

|

Overarching |

All learning |

All learning |

All learning |

All learning |

One or more of the |

A significant |

Most of the learning |

|

indicators: |

outcomes/assessment |

outcomes/assessment |

outcomes/assessment |

outcomes/assessme |

learning |

proportion of the |

outcomes/assessmen |

|

|

criteria have been |

criteria have been |

criteria have been met |

nt criteria have been |

outcomes/assessment |

learning |

t criteria have not |

|

|

achieved to an |

achieved to a high |

fully, at a good or very |

met. |

criteria have not been met. |

outcomes/assessment |

been met. |

|

|

exceptionally high level, |

standard, and many at an |

good standard. |

|

|

criteria have not been |

|

|

|

beyond that expected at |

exceptionally high level. |

|

|

|

met. |

|

|

|

Level 7, with features |

|

|

|

|

|

|

|

|

consistent with Level 8 |

|

|

|

|

|

|

|

|

(doctoral study). |

|

|

|

|

|

|

|

SUMMARY DESCRIPTOR: Learning accredited at Level 7 (Master’s) will reflect the ability to display mastery of a complex and specialised area of knowledge and skills, employing advanced skills to conduct research or advanced technical/professional activity, accepting accountability for related decision-making, including use of supervision. |

|||||||

|

Criteria |

Characteristics |

||||||

|

Subject knowledge & understanding (30% weighting) |

Exceptional investment appraisal knowledge and conceptual understanding at the forefront of the discipline. Authoritative approach to complexity investment appraisal using quantitative and qualitative approaches, and linking to the sensitivity of the investment and impact to the financial performance |

Comprehensive investment appraisal knowledge and conceptual understanding, informed by recent developments in the discipline, demonstrating reading/research at significant depth/breadth. Informed & confident approach to complexity about investment appraisal using quantitative and qualitative approaches and linking to the sensitivity of the investment. |

Detailed investment appraisal knowledge and conceptual understanding demonstrating purposeful reading/research. Developing awareness of complexity about investment appraisal using quantitative and qualitative approaches |

Broad investment appraisal knowledge and conceptual understanding, demonstrating directed reading/research. Some awareness of complexity about investment appraisal using quantitative and qualitative approaches. |

Reproduction of taught content and/or tendency to describe or report facts rather than demonstrate complex ideas surrounding investment appraisal through quantitative or qualitative approaches. Any errors or misconceptions are outweighed by the overall degree of knowledge & understanding demonstrated. |

Insufficient evidence of knowledge and understanding of investment appraisal using quantitative or qualitative approaches, and its underlying concepts. |

Little or no evidence of knowledge and understanding of investment appraisal using quantitative and qualitative approaches, or its underlying concepts. |

|

Higher cognitive |

Rigorous and sustained |

Strong and sustained |

Detailed criticality and |

General criticality |

Limited criticality and |

Mainly descriptive |

Little or no evidence |

|

skills & originality |

criticality, independent |

criticality and independent |

evidence of independent |

and some evidence |

independent thought, |

and/or inadequately |

of criticality and |

|

(30% weighting) |

thinking and original |

thinking/original insight; |

thinking/original insight; |

of independent |

leading to conclusions |

supported conclusions |

independence of |

|

|

insight; convincing |

persuasive conclusions |

logical and sustained |

thinking; logical |

and/or application to the |

and/or application to |

thought about the |

|

|

conclusions and/or |

and/or application to the |

conclusions and/or |

conclusions and/or |

motivation of the proposed |

the motivation of the |

motivation of the |

|

|

application to the |

motivation of the proposed |

application to the |

application to the |

investment that is poorly |

proposed investment. |

proposed investment. |

|

|

motivation of the proposed |

investment and linked to |

motivation of the |

motivation of the |

supported. |

|

|

|

|

investment and linked to |

the investment appraisal |

proposed investment. |

proposed |

|

|

|

|

|

the investment appraisal |

discussion. |

|

investment. |

|

|

|

|

|

discussion. |

|

|

|

|

|

|

|

|

PASS GRADES |

FAIL GRADES |

|||||

|

(100-85) |

(84 – 70) |

(69 – 60) |

(59 – 50) |

(49 – 40) |

(39 – 20) |

(19 – 0) |

|

|

Advanced |

Exceptional demonstration |

Purposeful, systematic, |

Purposeful, systematic, |

Skilled |

Developing expertise. |

Limited demonstration |

Little or no |

|

technical, |

of advanced technical, |

and sophisticated |

and skilled |

demonstration of |

Inconsistent |

of advanced technical, |

demonstration of |

|

professional |

professional and/or |

demonstration of |

demonstration of |

advanced technical, |

demonstration of |

professional and/or |

advanced technical, |

|

and/or research |

research expertise. |

advanced technical, |

advanced technical, |

professional a |

|||